“`html

Effective Ways to Calculate EBITDA: A Practical Guide for 2025

Understanding how to calculate EBITDA is crucial for businesses aiming to evaluate their financial health and operational efficiency. This financial metric provides insight into a company’s profitability by excluding interest, taxes, depreciation, and amortization. In this guide, we will explore the components of EBITDA, the EBITDA formula, and practical approaches for accurate EBITDA calculations to enhance your profitability analysis.

Understanding EBITDA and Its Importance

EBITDA, short for earnings before interest, taxes, depreciation, and amortization, serves as a key performance indicator for projecting a company’s operational profitability. By focusing primarily on earnings, it excludes variables that can distort a company’s financial picture. This makes it a vital tool for business valuation and insightful financial statement analysis. Furthermore, EBITDA is widely utilized in various financial assessments, making it an essential concept in areas such as investment analysis and financial forecasting.

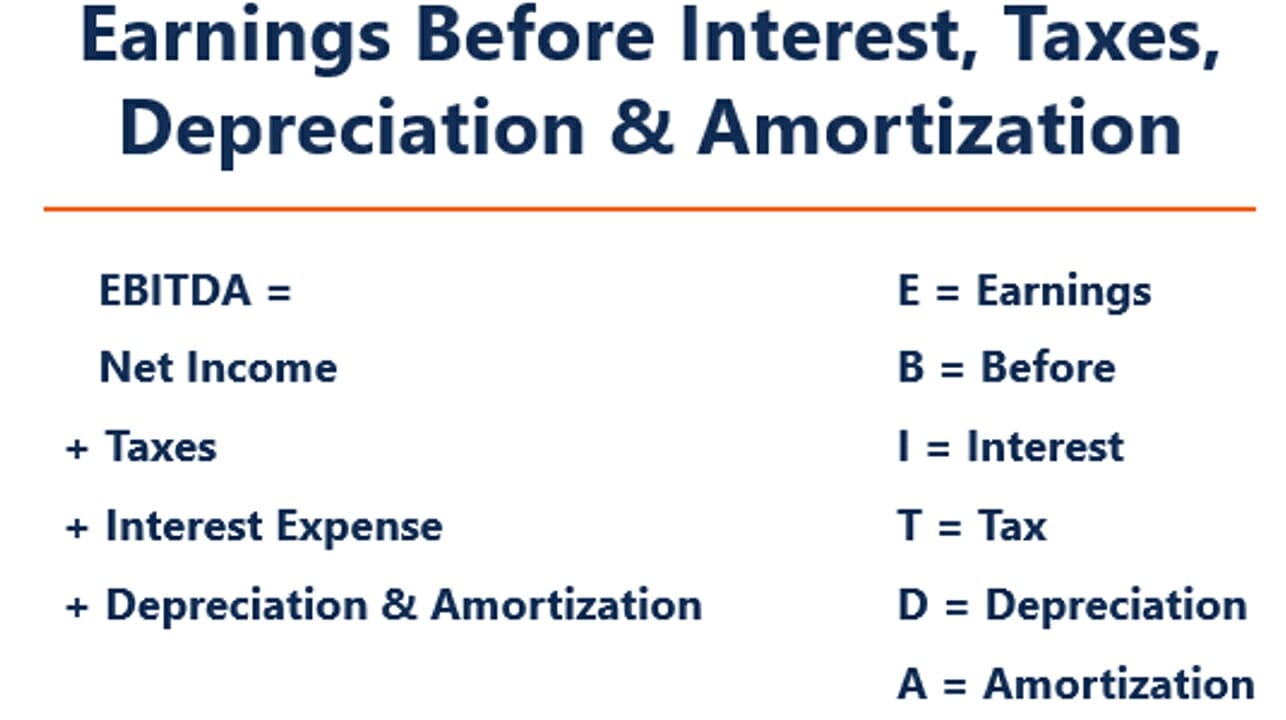

The EBITDA Formula Breakdown

The basic EBITDA formula can be simplified as: EBITDA = Operating Income + Depreciation + Amortization. It can also be expressed using net income: EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization. This transparency allows analysts to easily assess a company’s operational efficiency and make fair comparisons across different companies, regardless of their capital structure or tax situations. Understanding the formula helps to recognize adjustments that may affect profitability, thus allowing a clearer assessment of company performance.

Key Components of EBITDA Calculation

To calculate EBITDA accurately, various components must be accounted for. Operating income serves as the starting point, providing a reliable measure of profitability without the clutter of non-operational expenses. Additionally, adjustments for depreciation and amortization must be included to reflect the actual cash flow of the business. Understanding the impact of interest expenses and taxes is equally important, as these factors can significantly affect realized earnings. By properly identified, these adjustments offer a clear picture of a company’s financial performance.

EBITDA vs. Other Financial Metrics

Comparing EBITDA with other financial metrics, such as net income or operating cash flow, can yield valuable insights into a company’s overall performance. While net income accounts for all expenses, EBITDA focuses strictly on operational earnings, highlighting the ability to generate cash from core business activities. By using EBITDA alongside these metrics, management and investors can gain a balanced view of the company’s operational performance and profitability potential.

Calculating EBITDA: Step-by-Step Guide

This step-by-step approach provides a practical method for calculating EBITDA accurately, ensuring transparency and reliability in your forecasting and analysis.

1. Gather Financial Statements

Start by collecting the necessary financial statements including the income statement and balance sheet. Focus specifically on revenue, operating income, taxes paid, depreciation, and amortization. These components are critical for building a comprehensive understanding of the business’s revenue generation and expense management capabilities.

2. Adjust for Non-Operational Items

Identify and eliminate any non-operational expenses that might skew the profitability analysis. Non-recurring revenues and costs related to investments, scattered across the income statement, should be excluded to provide a clear depiction of operational strength. This process allows you to streamline the calculation by focusing solely on operational profitability and relevant earnings.

3. Calculate EBITDA

From your gathered data, apply the relevant formula to compute EBITDA. Incorporate the operating income together with depreciation and amortization. For example, if a company reports an operating income of $200,000, depreciation of $50,000, and amortization of $10,000, the EBITDA would be computed as follows: EBITDA = $200,000 + $50,000 + $10,000 = $260,000. This approach offers a focused view of how well the company is doing without the currying influence of external financial variables.

Uses of EBITDA in Business Analysis

Understanding the implications of how to calculate EBITDA is vital for utilizing this metric effectively in various business scenarios such as valuation multiples and determining operating efficiency.

Valuation and Investment Analysis

EBITDA plays a significant role in assessing business valuations and investment strategies. Investors often utilize EBITDA multiples to determine the fair value of a business. When institutions analyze companies for potential investments, they look for consistent or growing EBITDA figures as reliable indicators of financial health and performance potential. Operational metrics derived from EBITDA often predict investment returns, guiding effective capital budgeting decisions.

Performance Metrics for Stakeholders

For stakeholders, EBITDA offers an intuitive way to gauge improvement in a company’s operational performance. It serves as a simplified lens through which profitability and operational success can be evaluated over time. Using this financial performance indicator allows management to strategize appropriately, assess cost structure, and focus on enhancing margins, ultimately ensuring sustainable growth and profitability.

Assessing Cash Flow and Operational Efficiency

EBITDA also provides insights into cash flow from operations, helping management make informed decisions regarding capital expenditures and long-term investments. By evaluating this metric, companies can enhance their operational impact while focusing on improving revenue growth and optimizing cost structures. Ultimately, comprehending EBITDA’s effect is vital for creating effective budgeting strategies that align with investor expectations and long-term profitability goals.

Key Takeaways

- Understanding how to calculate EBITDA is essential for assessing financial health and operational efficiency.

- EBITDA calculations offer transparency in evaluating company performance and grant meaningful comparisons across similar entities.

- Utilizing EBITDA in investment and valuation analyses helps determine potential returns and make sound business decisions.

- Improving EBITDA metrics guides management in focusing on revenue generation strategies and cost management effectively.

- EBITDA is integral to understanding operational improvements, impacting overall profitability assessments.

FAQ

1. What is the significance of EBITDA in financial analysis?

EBITDA serves as a crucial financial metric that reveals a company’s operational performance without the impact of financial and accounting factors like debt interest and tax expenses. It highlights cash earnings attributable to operational activities, thus providing insights for investment analysis and business valuation.

2. How does EBITDA differ from net income?

EBITDA differs from net income by excluding interest, taxes, depreciation, and amortization, thereby offering a clearer view of a company’s operational profitability. Net income incorporates all expenses, which may obscure the core performance when evaluating financial health and operational efficiency.

3. Why should businesses focus on EBITDA for forecasting?

Focusing on EBITDA can enhance financial forecasting as it reflects a company’s core earning capacity, allowing for better projections related to cash flow and making informed operational decisions. It aids in assessing historical performance trends and facilitates accurate growth potential estimates.

4. How can EBITDA improve investment returns?

Using EBITDA as a performance metric can improve investment returns by effectively indicating a firm’s operational efficiency and profitability analysis. Investors tend to favor businesses with growing EBITDA figures as these are associated with higher valuation multiples and greater cash flow visibility.

5. What are the limitations of EBITDA as a performance measure?

While EBITDA is a useful indicator, it also has limitations, such as excluding critical expenses that can significantly impact overall profitability. It may not accurately reflect a business’s cash flow if substantial cash expenditures, interest expenses, or significant tax considerations affect financial results. Thus, it should be used alongside other financial measures for comprehensive evaluations.

“`