“`html

Smart Ways to Send Money on Cash App in 2025

As we move further into 2025, users are looking for efficient ways to manage their finances. With the popular Cash App money transfer service, sending money has never been more accessible. In this guide, we will explore practical tips for using Cash App effectively, covering aspects such as setting up Cash App, understanding the cash app payment process, and navigating its unique features.

Understanding Cash App: The Basics

Before diving into the more complex features of Cash App for beginners, it’s essential to comprehend how to start using Cash App efficiently. During the cash app account setup, users will be prompted to link their bank account, set up a cash app cash card, and improve their overall user experience.

Setting Up Your Cash App Account

The first step in the journey to mastering Cash App is to understand the cash app account setup. Begin by downloading the app from the App Store or Google Play. Once installed, create your account using your email or phone number. After this, you’ll need to verify your identity, which may require an additional email or phone number verification. This process is crucial for ensuring the security of your payments and allows you to access features such as cash app direct deposit.

Linking Your Bank Account

To fully utilize Cash App, you must link your bank account. This can be done easily in the app’s settings. Navigate to the “Linked Accounts” section and choose “Link Bank Account.” Enter your bank account details following the on-screen prompts, and you’re set! This step also enables cash app bank transfer options, making your money transfer seamless throughout various services.

The Cash App Payment Process

After setup, knowing the cash app payment process is crucial for smooth transactions. Whether sending money to friends, family, or making purchases, understanding the functionality of your Cash App can facilitate a better experience.

Sending Money Using Cash App

To send money using Cash App, open the app and enter the amount you wish to send. Next, choose the recipient by selecting their $Cashtag, phone number, or email address. You can add a note to describe the transaction if needed. Finally, tap “Pay” to complete your transfer. Be mindful of cash app sending limits, as they can affect how much money you can transfer at once.

Requesting Money and Cash App Payment Notifications

Cash App also allows users to request money through the app, which is useful if someone owes you money. To do this, choose the “Request” icon and input the amount and recipient’s details. Be sure to keep an eye on your cash app transaction history, which provides clear records of all payments made or requested. Enabling cash app payment notifications ensures you will be updated on all transactions, increasing your financial awareness.

Maximizing Cash App Efficiency

To get the most out of Cash App, familiarize yourself with its various features and settings. This knowledge helps you navigate the app like a pro and empowers you to take advantage of its offerings fully.

Cash App Fees and Rewards Program

Understanding cash app fees is paramount as certain transactions may incur costs. For instance, using a credit card to fund your transaction may lead to a 3% fee. On the other hand, linking a bank account or using your Cash App balance can help you avoid these fees. Additionally, participating in the cash app rewards program lets users earn rewards on transactions made with a Cash Card. Optimize your app usage by focusing on spending where rewards apply.

Cash App Security Features

When dealing with monetary transactions, security is paramount. Cash App includes features to enhance your account safety, such as cash app identity verification and notifications for unusual account activity. Utilizing these features is essential to safeguard against fraud and unauthorized transactions. Always enable two-factor authentication and review your cash app account settings regularly.

Key Takeaways

- Setting up your Cash App and linking your bank account are crucial first steps.

- Understanding the payment process, including sending and requesting money, will make transactions smoother.

- Be aware of the fees, transaction limits, and security features to maximize efficiency and safety in usage.

FAQ

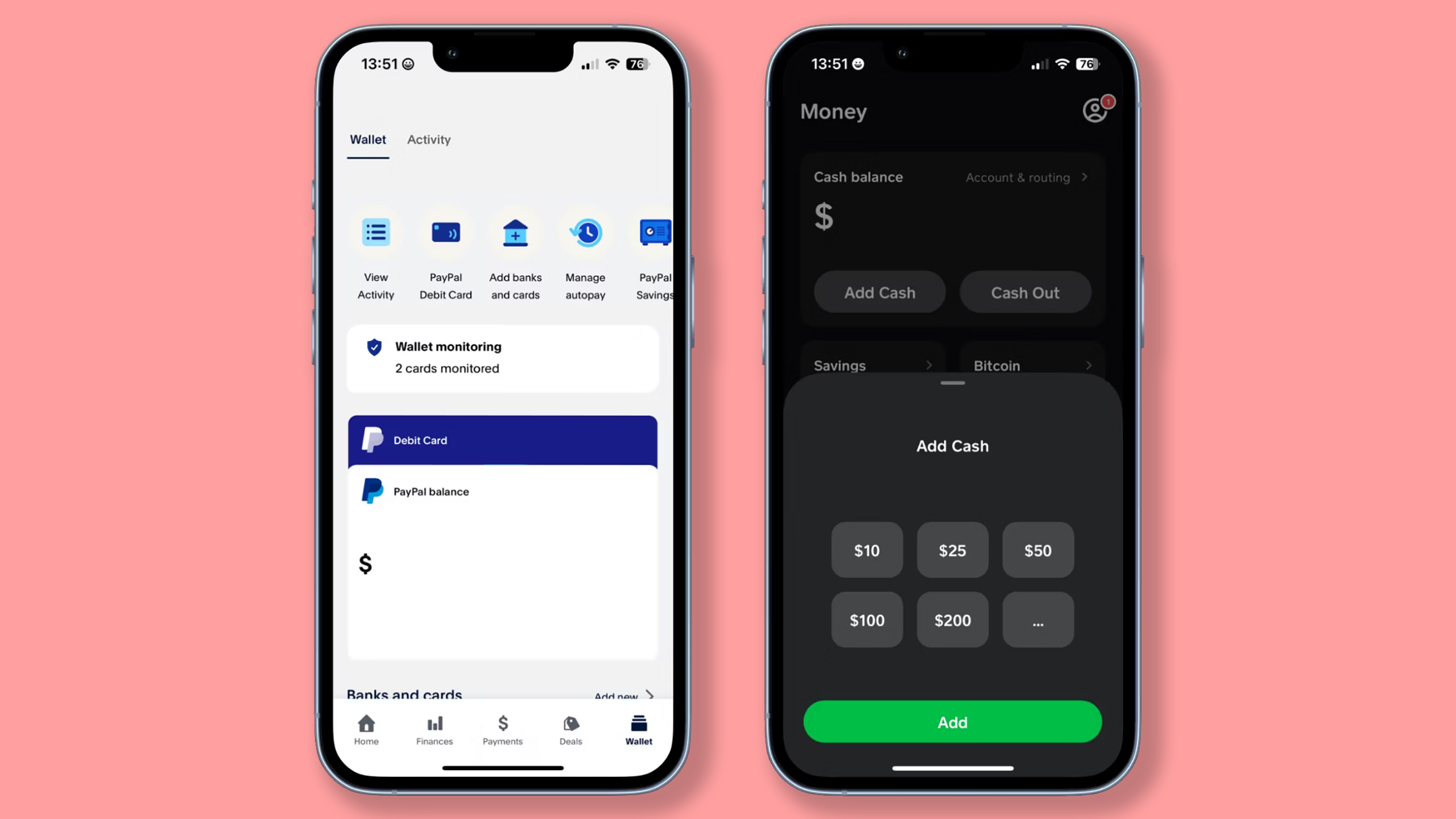

1. How do I add cash to Cash App?

To add cash to Cash App, visit a location that supports Cash App deposits. Select “Add Cash” in the app, choose the amount, and follow prompts. You can also add money directly from your linked bank account.

2. What are the Cash App transaction limits?

Initially, Cash App users have a $250 limit for 7 days. However, after verifying your account, you can raise this limit to $7,500 per week. Always check the app for the most accurate information on your personal limits.

3. Can I use Cash App for business purposes?

Yes, Cash App can be used for business transactions. Business accounts have different features, including additional payment solutions and options for invoicing clients. It’s a great tool for freelancers and small business owners.

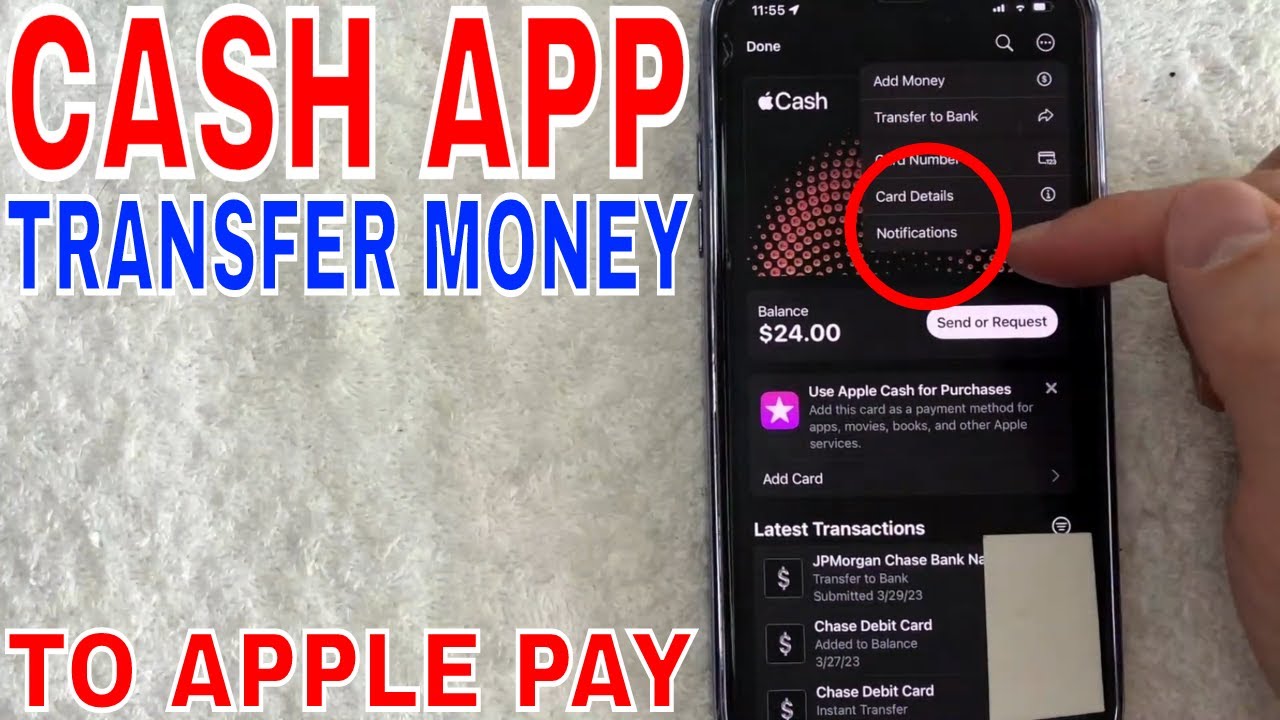

4. How do I withdraw money from Cash App?

To withdraw money from Cash App, tap the bank icon in the lower right corner, choose “Cash Out”, and input the desired amount. Then you can select the speed of transfer—standard (free) or instant (with a fee).

5. What should I do if I encounter issues with cash app support?

If you have difficulties with Cash App, you can reach their customer service through the app. Additionally, check the cash app email support or the cash app community forum for troubleshooting tips from other users.

“`