“`html

Effective Ways to Calculate Revenue for Your Business in 2025

Understanding how to calculate revenue is crucial for the sustainability and growth of any business. As we move into 2025, the landscape of revenue calculation is evolving with new methodologies and tools. In this article, we will explore proven revenue calculation methods, revenue forecasting techniques, and practical ways to measure your business’s financial performance.

Understanding Revenue Calculation Methods

To effectively grasp the concept of revenue, it’s vital to familiarize yourself with various revenue calculation methods. Different businesses may require different approaches based on their revenue streams. The most common methods include the direct and indirect revenue calculation. Direct revenue calculation involves tracking sales made directly from products or services, while indirect revenue considers various factors like advertisements and partnerships. Each technique has its own set of metrics that businesses must analyze to ensure accurate reporting. This foundational understanding serves as the springboard for employing advanced calculation techniques.

Calculate Revenue from Sales

When businesses want to assess their primary income source, they often focus on calculating revenue from sales. This calculation is straightforward: add up all the sales figures over a specified period. The simplistic revenue formula is essentially the total unit price multiplied by the quantity sold. However, data collection tools can greatly enhance the accuracy of this calculation. For instance, using cloud-based revenue management software can helps in accurately tracking sales across multiple channels. This allows for a more granular analysis of sales data, which in turn facilitates better growth strategies.

Monthly vs. Annual Revenue Analysis

When measuring revenue, businesses often conduct both monthly revenue growth and annual analyses to gain a comprehensive view of their financial health. Monthly revenue analysis offers the advantage of identifying trends in a timely manner, allowing businesses to adjust their strategies. Annual analysis, on the other hand, helps evaluate long-term performance and informs future budgeting decisions. By recognizing seasonal patterns, businesses can formulate revenue growth strategies that can mitigate downturns and capitalize on peak seasons.

Revenue Reporting Standards

Another critical aspect of effective revenue calculation involves adhering to revenue reporting standards. These standards dictate how revenue should be reported and recognized in financial statements. Understanding these principles is essential for compliance and transparency. Companies must utilize standardized methods to calculate and report revenue to avoid discrepancies. Familiarizing your team with these standards ensures everyone understands regulatory requirements and maintains consistency when calculating total revenue.

Revenue Forecasting Techniques

Effective revenue forecasting is key to strategic business planning. By employing robust revenue forecasting techniques, businesses can predict future earnings based on historical data and market conditions. Various methodologies, including qualitative forecasting, regression analysis, and trend analysis, can be powerful tools for predicting revenue streams. This section dives into different forecasting methods and their practical applications in real-world business scenarios.

Calculating Projected Revenue

One of the most crucial forecasting methods is calculating projected revenue. This process involves analyzing historical sales data to establish trends that inform future projections. Businesses might use sales cycle data to identify growth patterns and forecast anticipated revenue. Incorporating advanced tools like predictive analytics improves the accuracy of these projections, allowing businesses to adapt their strategies proactively. For example, a company using machine learning techniques could effectively analyze past customer data to predict future buying behavior, thereby enhancing revenue forecasting accuracy.

Revenue Growth Rate Measurement

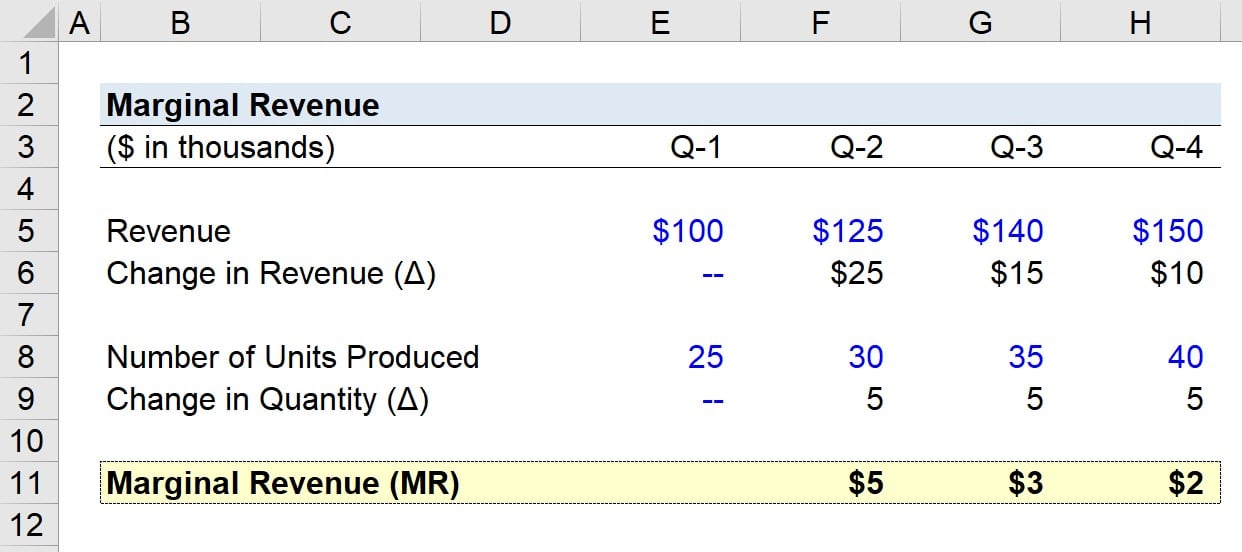

Measuring revenue growth rate is critical for evaluating the success of marketing strategies and overall business performance. This metric tracks the percentage increase in revenue over a specific period, providing insights into the effectiveness of your plans. To calculate the revenue growth rate, subtract the previous period’s revenue from the current period, divide it by the previous period’s revenue, and multiply by 100. Regularly calculating this metric assists businesses in making informed decisions regarding resource allocation and scaling objectives.

Challenges in Revenue Forecasting

While forecasting revenue, businesses often face challenges in revenue forecasting, such as fluctuating market conditions and economic uncertainties. Accurate data collection and analysis become vital in overcoming these challenges. Utilizing revenue projection tools equipped with AI can help refine accuracy by adjusting forecasts based on real-time data. Moreover, regularly revisiting and updating forecasts helps companies remain adaptable and proactive in managing financial strategy.

Calculating Revenue Growth and Potential

Revenue growth analysis equips businesses with the ability to identify opportunities for expansion and increased profitability. The techniques for revenue growth calculation include evaluating existing revenue streams and exploring new markets or products.

Understanding Revenue Drivers

Identifying and calculating revenue drivers involves recognizing what specific factors contribute to income generation. Examples of revenue drivers include customer satisfaction, service quality, and effective marketing campaigns. Businesses should utilize tools to monitor these drivers carefully and adjust strategies as needed. An example of this would be a subscription service analyzing user behavior data to identify trends that predict customer churn or growth.

Revenue Performance Indicators

Implementing revenue performance indicators is essential for measuring how well a company is doing financially. These metrics can help identify areas of strength and weakness within revenue generation. Key indicators may include customer acquisition costs, churn rates, and average revenue per user (ARPU). Businesses that consistently monitor these metrics can implement adjustments that lead to enhanced profitability.

Optimizing Revenue Streams

To fully capitalize on business potential, owners must pursue revenue optimization strategies. This might involve revisiting pricing strategies, enhancing customer engagement, or exploring new distribution channels. For instance, if data shows certain products significantly outperform others, businesses should consider reallocating resources toward promoting those successful items, maximizing their revenue streams.

Key Takeaways

- Understanding various revenue calculation methods is essential for business health.

- Accurate revenue forecasting can significantly enhance strategic planning.

- Measuring revenue growth enables you to explore expansion and optimize existing streams.

- Utilizing key financial metrics provides insight into effective business performance.

- Regularly evaluating and optimizing revenue processes is key to sustaining growth.

FAQ

1. What are the best tools for calculating revenue?

The top revenue calculation software includes platforms like QuickBooks and FreshBooks, which simplify the tracking and reporting process. These tools not only help in calculating total revenue but also offer insights into revenue cycles and management. Utilizing comprehensive software solutions can enhance accuracy and ensure compliance with reporting standards.

2. How can I calculate revenue per client effectively?

To calculate revenue per client, divide the total revenue by the number of active clients within a given period. This metric gives insight into profitability trends and customer value, helping businesses optimize strategies for retaining and drawing in new clients by enhancing offerings and customer satisfaction.

3. What is the revenue growth rate and why is it important?

The revenue growth rate measures how quickly a company’s revenue is increasing and is expressed as a percentage. It’s essential because it indicates company performance, guides investment decisions, and ensures that growth strategies are aligned with market opportunities.

4. What are revenue streams and why analyze them?

Revenue streams analysis involves investigating various income sources that contribute to total revenue, such as sales and subscriptions. Understanding these streams can help a business identify high-performing channels and explore underutilized areas for potential growth.

5. How to forecast revenue accurately?

Accurate revenue forecasting can often be achieved using advanced revenue forecasting techniques. Combining historical data, trend analysis, and statistical modeling ensures results that reflect market conditions and business performance, aiding in more strategic financial planning.

“`