How Much Do You Need to Make to Afford $1,500 Rent?

As housing costs continue to rise, understanding how much you need to earn is essential for budgeting effectively. This article explores the necessary calculations to determine your income requirements for a $1,500 monthly rent in 2025. With practical strategies and tips, you will be equipped to make informed financial decisions about rent affordability and managing your housing expenses.

Calculating Rent Affordability

To calculate how much you need to make to afford $1,500 rent, you need to assess your total income in relation to your housing expenses. A widely accepted guideline for achieving rent affordability is the 30% rule, which suggests that no more than 30% of your monthly gross income should go toward housing costs. For example, if you are paying $1,500 in rent, your monthly income should be approximately $5,000. This ensures that your rent does not strain your finances, allowing room for other essential expenses such as food and transportation.

Understanding Rent Versus Income Management

Financial planning for rent often requires a deep understanding of your overall financial habits. By calculating your rent income ratio—your monthly rent divided by your gross monthly income—you can measure how feasible your housing costs are. A good target for rent to income ratio is typically below 30%. If your income is $5,000, dividing your rent by this figure gives you a rent-to-income ratio of 30%. Sticking to this guideline helps with budgeting for housing costs and keeps potential financial stressors at bay.

Utilizing a Rent Affordability Calculator

There are many online tools available that can help in determining rent affordability. A rent affordability calculator allows you to input your income, monthly expenses, and other financial factors. These calculators can yield an accurate picture of how much of your salary is allocable to rent expenses. They also often display information on market trends and related expenses, which assists in understanding your comprehensive monthly housing budget.

Factors Influencing Income Requirements for Rent

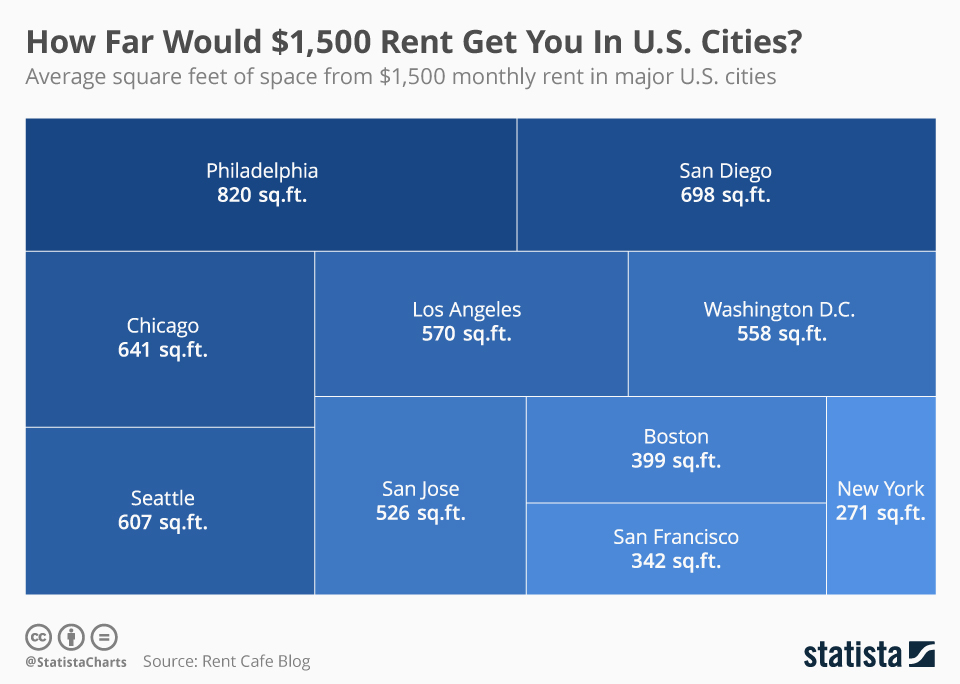

Several factors contribute to the income necessary for affording rent. One pivotal element is the cost of living in your area. In high-demand cities, the average rent may be higher, which inevitably increases your income requirement for $1,500 rent. Additionally, the economic landscape—including inflation rates and local housing market conditions—can significantly impact the necessary salary to comfortably manage rent payments.

The Importance of Budgeting for Housing Costs

Budgeting for a rental property is not merely about the rent. It’s essential to consider other housing-related costs such as utilities, internet service, and maintenance fees. When calculating what you must earn to afford $1,500 rent, incorporate these costs into your monthly housing budget. For instance, if monthly utilities add an additional $300, your total housing expenditure becomes $1,800. Adhere to the recommendation of keeping your housing costs at about 30% of your income, so for it to be manageable, you’d need to earn at least $6,000 monthly to stay within the affordability guidelines.

Exploring Income Sources for Rent

When looking at income required for rent, assess all possible income sources to cover your monthly rental costs. Full-time employment may be your primary income source, but consider other avenues such as part-time work, freelance gigs, or passive income streams like investment returns. These alternatives can help bolster your financial base, allowing you to better meet your rent obligations without overextending yourself.

Tips for Renting Affordably

Managing expenses effectively can greatly improve your ability to pay for rent. Here are some tips for renting affordably:

- Negotiate Rent Prices: When discussing rental agreements, don’t hesitate to negotiate. Many landlords may be willing to lower the rent in exchange for a longer lease or a solid rental history.

- Find Roommates to Share Expenses: Sharing rent with roommates can drastically reduce your individual rental cost, making affordability more attainable.

- Explore Assistance Programs for Housing: Check if you qualify for any government or local assistance programs designed to help renters. This can substantially alleviate the financial burden while preserving your savings.

- Improve Your Credit Score: A better credit score can lead to lower interest rates and larger rental avenues as landlords typically favor tenants with good credit.

Emergency Funds and Rental Stability

Having an emergency fund is crucial for financial stability when renting. This fund should ideally cover at least 3-6 months of living expenses, allowing you peace of mind in case of unforeseen events, such as job loss. To achieve this while managing rent pay can be challenging but possible with a well-structured savings strategy for rent. Prioritize your savings plan, even if it means temporarily cutting back on non-essentials.

Key Takeaways

- Adhere to the 30% rule to assess rent affordability.

- Utilize online tools to determine your focused rent affordability with rent calculators.

- Custom budget planning should incorporate all housing expenses, not just rent.

- Explore multiple income streams to enhance financial stability for your rent.

- Implement practical strategies to negotiate rent and share living costs effectively.

FAQ

1. What other costs should I consider when calculating rent affordability?

When calculating rent affordability, it’s crucial to consider additional housing costs, including utilities, maintenance fees, internet services, and renters’ insurance. These expenses can significantly impact your financial roadmap. By incorporating these into your monthly housing budget, you’ll grasp a clearer picture of what your total income needs to be for comfortable living.

2. How can I improve my financial qualifications for rent?

Improving your financial qualifications can be achieved through several approaches: maintaining a robust credit score, showcasing rental history, securing a stable income source, and providing documentation that proves your financial reliability, such as bank statements or pay stubs. Each of these aspects can appeal positively to landlords, making securing rental properties easier.

3. What happens if my income is less than the required amount for my rent?

If your income is below the amount needed to afford your rent, it’s essential to reassess your expenses and explore alternative income sources. Consider finding a roommate to relieve some costs or augmenting your income with part-time work or freelance opportunities. Additionally, seeking out affordable housing solutions can help align your rent burden with your financial reality.

4. How do inflation rates impact my rent planning?

Inflation rates affect all aspects of life, including rent. Increased inflation generally translates to higher costs of living, which can influence rental prices in your area. It is essential to factor inflation into your financial planning to ensure your income aligns with the anticipated increase in housing costs so that you can continue to comfortably afford your essentials.

5. Can I negotiate my rent price easily?

Yes, negotiating rent is possible and often advisable, especially if you’ve researched comparable properties in your area. Present your case by highlighting your positive rental history or time as a tenant, reasoning if the property has certain deficiencies, or if you’re willing to sign a longer lease for a reduced rate. Effective communication with landlords about your situation may lead to favorable results.