Essential Guide to How to Calculate Net Sales in 2025

Calculating net sales is crucial for businesses seeking to gain insights into their sales performance and financial health. In this guide, we will explore the net sales formula, discuss how to calculate net sales accurately, and analyze the importance of net sales in understanding business profitability. By the end, you’ll have a clear grasp of how to determine net sales and effectively apply this knowledge for improved business performance.

Understanding Net Sales Definition

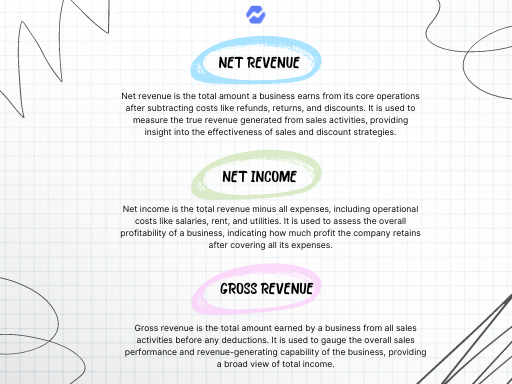

To effectively calculate net sales, it’s essential to first understand its definition. Net sales represent the total revenue generated from sales, accounting for returns, discounts, and allowances. By subtracting these adjustments from the gross sales figure, businesses can illuminate their actual revenue performance. This calculation provides a clearer picture of business profitability and is integral for financial reporting. Understanding net sales is vital for stakeholders who rely on these numbers to make informed decisions, whether it’s evaluating business performance or planning future strategies.

Components of Net Sales

When calculating net sales, it is crucial to consider its components. The primary elements involved in the net sales calculation method include:

- Gross Sales: The total sales revenue before any deductions.

- Returns and Allowances: The value of returned goods and allowances given to customers for issues like faulty products.

- Sales Discounts: Reductions offered to customers to incentivize purchasing.

By accurately assessing these components, businesses can achieve a refined net sales figure, leading to more effective sales income assessment and overall financial metrics evaluation.

Calculating Net Sales

Now that we understand the components of net sales, let’s explore the actual calculating net sales process with a clear formula:

Net Sales = Gross Sales – (Returns + Allowances + Discounts)

For example, if a business has $100,000 in gross sales, $5,000 in returns, $2,000 in allowances, and $1,500 in discounts, the calculation would look like:

Net Sales = $100,000 – ($5,000 + $2,000 + $1,500) = $91,500

This method ensures accurate sales reporting and plays a significant role in financial performance indicators essential for any business’s revenue tracking.

Net Sales vs. Gross Sales: Key Differences

Understanding the difference between net sales and gross sales is vital for effective financial reporting and analysis. Gross sales represent the sum total of sales before any deductions are applied, while net sales provide a more precise measure of revenue after accounting for returns, allowances, and discounts. This distinction is important for businesses, as it influences various financial metrics and decision-making processes. Focusing solely on gross sales can create an inaccurate perception of financial health, which is why sales adjustments and detailed sales breakdown are essential for achieving a complete view of financial performance.

Importance of Net Sales in Financial Performance

The significance of net sales extends beyond just revenue reporting. It impacts various financial indicators crucial for assessing the overall health of the business. Understanding net sales enables stakeholders to analyze profitability trends over time, evaluate pricing strategies, and monitor financial projections effectively. By integrating net sales into cash flow analysis and operational efficiency assessments, businesses can derive actionable insights and improve their financial decision-making capabilities.

Using Net Sales for Pricing Strategies

Businesses can leverage net sales insights to devise effective pricing strategies. By analyzing sales trends, companies can identify profitable products and determine optimal pricing points to stimulate demand without sacrificing revenue. Additionally, understanding the relationship between net sales growth and market dynamics can drive more refined strategic decisions, ultimately enhancing overall profitability. Consider examples from retail environments where price adjustments based on net sales analytics significantly increased market share and revenue growth.

Analyzing Net Revenue for Better Business Insights

Finally, conducting a net revenue analysis offers deep insights into a company’s operational strategies and effectiveness. Regular assessments of net sales allow businesses to spot changes in customer purchasing behavior and other external factors impacting performance. Incorporating financial metrics, such as margins on sales and profit analysis methodologies, alongside financial statements, enriches the understanding of a company’s operational efficiency, leading to better profitability predictions.

Impact of Returns and Allowances on Net Sales

Returns and allowances have a direct effect on net sales. A higher return rate may indicate issues with product quality or customer satisfaction, consequently impacting overall profitability margins. As such, businesses must monitor and assess these sales deductions to maintain growth. Implementing robust return policies and addressing underlying issues can mitigate negative impacts on net sales. This analysis also contributes to future sales forecasting methods, ensuring more accuracy in business projections.

Trends Impacting Net Sales

Shifting market trends can significantly influence net sales. Economic factors, changing consumer preferences, and industry-specific dynamics can all lead to fluctuations in net performance. By staying attuned to these trends, businesses can tailor their operational and sales strategies accordingly. Implementing market share assessments allows businesses to adjust their approach proactively, enabling sustainable growth and enhanced market positioning.

Key Takeaways

- Understanding the definition and components of net sales is fundamental for accurate financial reporting.

- Net sales differ from gross sales and provide deeper insights into a business’s financial health.

- Analyzing trends, returns, and allowances is crucial for maintaining profitability and developing effective sales strategies.

- Incorporating net sales into financial metrics assists in understanding performance and guiding future decisions.

FAQ

1. How is net sales important for businesses?

Net sales are vital for businesses as they reflect realistic revenue figures after accounting for returns, discounts, and allowances. This metric aids in evaluating financial performance indicators, guiding pricing strategies, and informing operational efficiency assessments, ensuring that stakeholders make informed financial decisions.

2. What are typical sales deductions to consider in net sales calculations?

Typical sales deductions include returns and allowances for defective or unsatisfactory products and sales discounts offered during promotional efforts. Understanding these adjustments helps refine the overall sales revenue calculation and ensures accurate financial disclosures.

3. How can businesses improve their net sales performance?

Businesses can enhance net sales performance by analyzing customer feedback regarding returns and allowances, optimizing pricing strategies based on market trends, and implementing effective sales management practices. Regular monitoring of sales data will also allow companies to make more informed decisions and boost overall profitability.

4. What role do sales discounts play in net sales?

Sales discounts reduce the gross sales figure, helping to calculate net sales. Businesses often use these discounts strategically to stimulate demand, enhance customer loyalty, and maintain competitive pricing. However, it’s crucial to balance discounts, as excessive reduction can negatively impact the bottom line.

5. How can net sales be utilized in financial forecasting?

Net sales provide a reliable basis for projection methods in financial forecasting. By analyzing trends in net sales data, companies can develop more accurate estimations for future revenue streams, which is essential for budgeting, resource allocation, and strategic planning efforts.

6. What is the difference between net sales and net income?

Net sales refer to the total revenue from sales minus returns, allowances, and discounts, while net income indicates total earnings after all expenses, including cost of goods sold, operating costs, taxes, and other deductions. Understanding this distinction is crucial for assessing overall business profitability and financial health.

7. Why is accurate sales reporting important?

Accurate sales reporting is crucial because it informs business decisions, impacts financial statements, and ensures compliance with accounting principles. It allows stakeholders to track revenue, analyze financial health, and assess profitability metrics, leading to better strategic planning and performance measurement.

Regularly monitoring the numeric findings will not only improve your fiscal function but enhance your strategic approach in market engagement!