How to Properly Fill a Check: Essential Tips for 2025

Filling a check properly is crucial for ensuring accuracy, legitimacy, and compliance with banking standards. In 2025, understanding the process and adhering to best practices is more important than ever. This guide provides essential tips, techniques, and procedural guidelines to help you navigate the check-filling process effectively. By following these tips, you can ensure that each check you write is completed clearly and accurately, thereby avoiding common errors and complications.

Understanding the Check Filling Process

The **process** of filling a check involves specific steps that must be executed with attention to detail and clarity. A check consists of various components including the date, payee name, dollar amount, and signature, all of which require methodical attention to ensure the check is filled out correctly. Understanding these **requirements** is the first step in achieving accuracy and facilitating any future **verification** or **validation** efforts. Each element of a check serves a purpose, and ensuring that it aligns with banking guidelines is essential for **compliance** and financial efficiency.

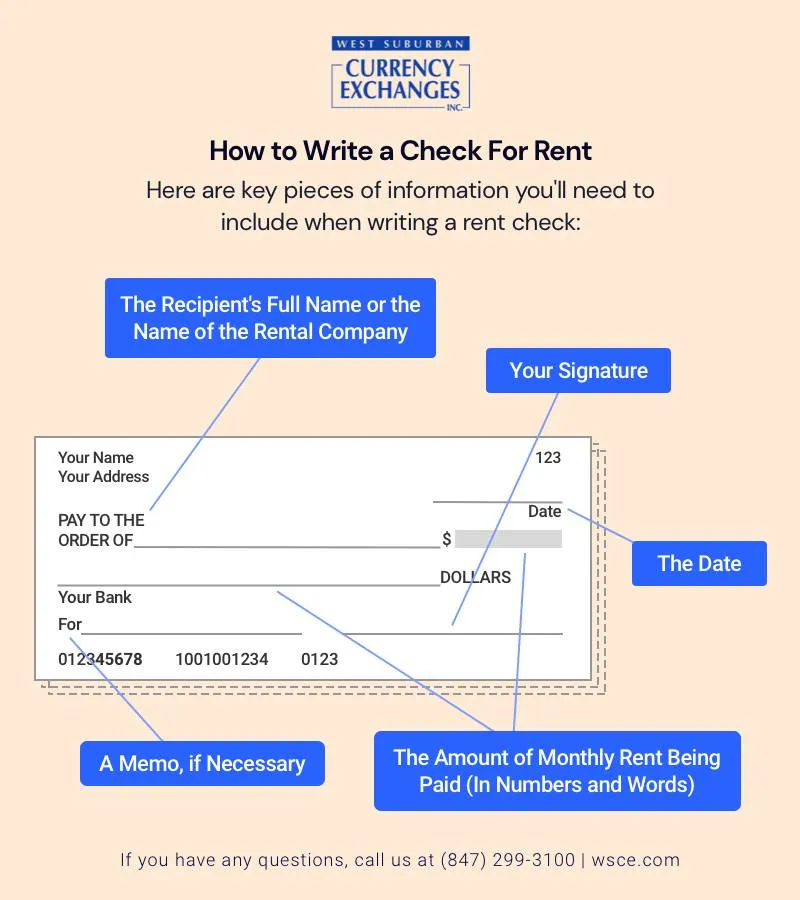

The Key Components of a Check

A standard check includes several key components: the **date**, **payee**, **amount in words**, **amount in numbers**, **memo line**, and **signature**. Each of these sections needs to be filled out in a systematic manner. For instance, ensure that both the written amount and numerical amount are the same to minimize disputes. Mismatches between these two can lead to the check being rejected, demonstrating the importance of thorough checks before submission. Use permanent ink to avoid alterations, ensuring the integrity of the document remains intact.

Steps for Accurate Completion

To facilitate an efficient filling process, consider following these structured steps. Start with the date, format it in MM/DD/YYYY, and ensure clarity. Next, move on to naming the payee accurately and in full. For the amount, first write the sum in numbers followed by the word form to enhance **clarity** and prevent alterations. On the **memo line**, you can add a note regarding the purpose of the payment, which can serve as a record-keeping practice later on. Lastly, your **signature** authenticates the check, providing a final layer of verification.

The Importance of Review and Validation

Before issuing a check, always engage in a thorough review process. Double-check all entries against your intended details to avoid accidental errors. This practice adds an extra layer of clarity and serves as an **accuracy verification** step. Employ a checklist to ensure you haven’t missed any sections during filling. Keeping organized records of issued checks can enhance your tracking process and serve as essential documentation for both personal and business expenses.

Techniques for Effective Check Writing

Utilizing efficient techniques while filling out checks can streamline your process and enhance overall effectiveness. Developing a methodical approach allows for both speed and accuracy in this essential task. These **best practices** can be laid out simply yet effectively to ensure consistent check completion.

Utilizing Fillable Forms for Check Writing

As we embrace technology, using fillable forms can significantly enhance the check-writing experience. Many banks now offer templates that are easier and faster to complete. You can fill out all necessary fields electronically, reducing errors related to handwriting and improving **clarity**. Always ensure that you are inputting the data into a secure platform to maintain the integrity of your **sensitive information**.

Documentation Practices for Future Reference

Good documentation practices are pivotal for both auditing and verifying your check transactions. Keep a copy of each issued check, either digitally or in paper format, which can aid in future audits or inquiries. Utilize tools or software for record-keeping that can help you track payments against invoices, ensuring compliance with organizational standards.

Establishing Consistency in Actions

Maintaining a consistent approach to filling checks can enhance your efficiency in managing finances. Design a structured method to follow each time a check is filled to establish a habitual approach. This could include creating a repeatable checklist for essential **documentation**, ensuring that no detail is overlooked and that the outcome is uniformly positive.

Final Recommendations for Filling Checks

In conclusion, filling checks is a procedural task that should involve careful attention to multiple factors. Laid out in this guide are key strategies and tips that underline the importance of accuracy, clarity, and proper documentation practices. As you approach 2025, adopting these recommendations will not only ensure effective check writing but will also facilitate compliance with evolving banking standards.

Emphasizing Clarity and Efficiency

Above all, clarity in writing checks allows for fewer misunderstandings and promotes **efficiency** in managing transactions. Using easy-to-read handwriting, following a structured procedure, and reviewing completed checks enhances your effectiveness and organizes your financial activities seamlessly.

Monitoring Changes in Banking Procedures

Stay informed about any changes in banking practices or compliance regulations related to check writing in your area. Being proactive can help you adjust your methods in accordance with new standards, ensuring that your practices remain relevant and effective.

Continual Improvement and Adaptation

Finally, engage in continual assessment of your check-filling practices. Gather feedback from your experiences, and adapt your strategies accordingly. Keep an eye on emerging tools and technologies that can further enhance your financial management processes in terms of check writing.

FAQ

1. What is the correct way to fill out a check for business payments?

Filling out a check for business payments requires following the same basic steps as personal checks. You’ll want to ensure that the company name is accurately entered as the payee, the amount coincides with what’s stated in business invoices, and the purpose of the payment is noted in the memo. It’s crucial to also maintain documentation for each business check issued for audit trails.

2. How can I ensure my checks are secure from fraud?

To enhance the security of your checks, consider using checks with built-in security features like watermarks and unique patterns. Always store your checks in a secure location, and when filling them out, avoid leaving spaces before the amount or signature to prevent unauthorized alterations.

3. What should I do if I make a mistake on a check?

If an error occurs while filling out a check, it’s advisable to void the check and write a new one. Simple crossings or corrections may not ensure the check’s validity, and most banks prefer not to process checks with visible corrections. Always ensure that the documentation reflects any changes made.

4. Are there any specific forms required when filling out a check for payments?

While there are no specific forms required for most checks, ensuring that your checks are formatted correctly according to banking standards is essential. Utilizing check templates can often provide guidance on required formats. Always refer to local banking regulations for any unique compliance requirements.

5. How can I find out if a check has been cashed?

You can confirm if a check has been cashed by reviewing your bank statement online or by contacting your bank directly. Many banks also provide transaction alerts that notify you when a check has been processed, allowing you to track the status easily.

6. What are the consequences of filling a check incorrectly?

Filling a check incorrectly can lead to a variety of issues, including payment delays, checks being returned, or even potential disputes over payments. In serious cases, it may raise concerns of fraud, leading to potential legal implications depending on the severity of the errors made.

7. Is it necessary to have a checkbook with my bank?

No, it’s not strictly necessary to have a checkbook with your bank. However, having one can facilitate easier payments and cash management, especially for individuals or businesses that prefer to keep traditional methods for accounting purposes.